Here is my reasoning about 401K.

First, I’ll start with two definitions: (1) taxable income, meaning the gross income you receive on which your tax will be calculate; (2) tax deduction, meaning any deduction from your taxable income. Tax deduction lowers your taxable income thus lowers your tax in general.

401K has three categories:

Pre-tax: contribute your taxable income directly to the 401K account, without paying the tax at the time of contribution.Hence, pre-tax 401k is a way of tax deduction. You can only withdraw after 59.5 age, and every dollar you withdraw (i.e., the money you contribute + its growth) will need to be taxed based on the tax bracket you are in at the time of withdraw (i.e., the time when you are old and probably don’t have high income.)

Roth: contribute your after-tax income to the 401K account [1]. You can only withdraw after 59.5 age, but you don’t pay any tax at the time of withdraw (including for the part you earn).

After-tax: contribute your after-tax income to the 401K account separate with roth or pre-tax. However, you still need to pay tax on the earnings when withdrawing: “the earnings on after-tax contributions, just like all distributions from pre-tax contributions, are taxed as ordinary income” [4]. What’s more, there is 10% early withdraw penalty on the earnings too if you withdraw before 59.5 age. The early withdraw penalty and tax on the earning is proportionally collected [5]. If your total after-tax contribution has accumulated x% earning, then you have to pay tax and penalty on x% of whatever amount of money you withdraw before 59.5.

There is another age rule on 401K account: you can defer withdrawing 401K if you work at your elder age. But if you are over 70 years, you need to start withdrawing with at least the amount of Required Minimum Distribution (RMD) each year [7].

The annual combined limit of 401K pre-tax+ roth is 19000 as of 2019. However, there is another limit [3] that restricts you from contributing more than 56000 in any kind of retirement plan per year. That means, if you fully contribution 19000 in pre-tax + roth 401K, than you contribution to 401K after-tax plus employer match should not be over 56000 – 19000=$37000. There is another limit not for 401K but for IRA (individual retirement account), which is 6K.

The benefit of 401K after-tax contribution isn’t apparent. One underlying purpose of saving in after-tax account is to bypass the limit of 19000 for pre-tax + roth. You can rollover your after-tax amount from after-tax 401K to Roth 401K then to Roth IRA, another type of retirement account which is very similar to Roth 401k in the sense that anything going into it will be tax-free. At the time of rollover from after-tax 401K to Roth 401K, any earning in the after-tax account would be treated as your ordinary income thus become taxable; but after rollover, the whole amount of money as well as all future earnings would be tax-free.

In many situations, you need some triggering events (such as retirement, changing companies, etc.) to be able to rollover from after-tax 401K to Roth IRA. Only a few companies offer the opportunity to rollover from after-tax to Roth IRA directly without any triggering event. My company (FB) supports rollover from after-tax 401K to Roth 401K immediately after any contribution in after-tax 401K, meaning that I don’t need to pay any tax for the rollover because no earning has been generated before the rollover happens. And our company’s employees can rollover from Roth 401K to Roth IRA at any time.

The withdraw rules of Roth IRA are summarized as follows. Assume you only contribute to Roth IRA by converting from after-tax 401K. You can withdraw the converted money (principle, not earning) after they have stayed in Roth IRA for more than 5 years without penalty [8]. You can withdraw the earning part without penalty if after age 59.5 or die or become disabled or withdraw within 10000 for first-home purchase and at the same time the first Roth contribution must have started more than 5 years ago; otherwise you need to pay penalty of 10% on the earning [6]. As discussed in [8], the earning that the penalty will apply on is the pre-rollover earning (before you rollover from After-tax 401K to Roth 401K). So since my company allows to rollover from After-tax 401K to Roth 401K immediately, I don’t need to pay any penalty at all even I withdraw from Roth IRA within 5 years since my Roth IRA contribution!

So it seems like if you have any money investing to 401k after-tax, it is better to roll over to Roth IRA (if your company allows that during your employment) because (1) Roth IRA doesn’t incur any tax while 401k after-tax still incurs tax on earnings after age 59.5 (2) Roth IRA is more flexible in withdrawing the converted part of money (you can withdraw even before 59.5 years old).

Now let’s talk about the appropriate distribution of 401K money. Here is a chart showing the suggested 401K amount you should save at each age group [11]:

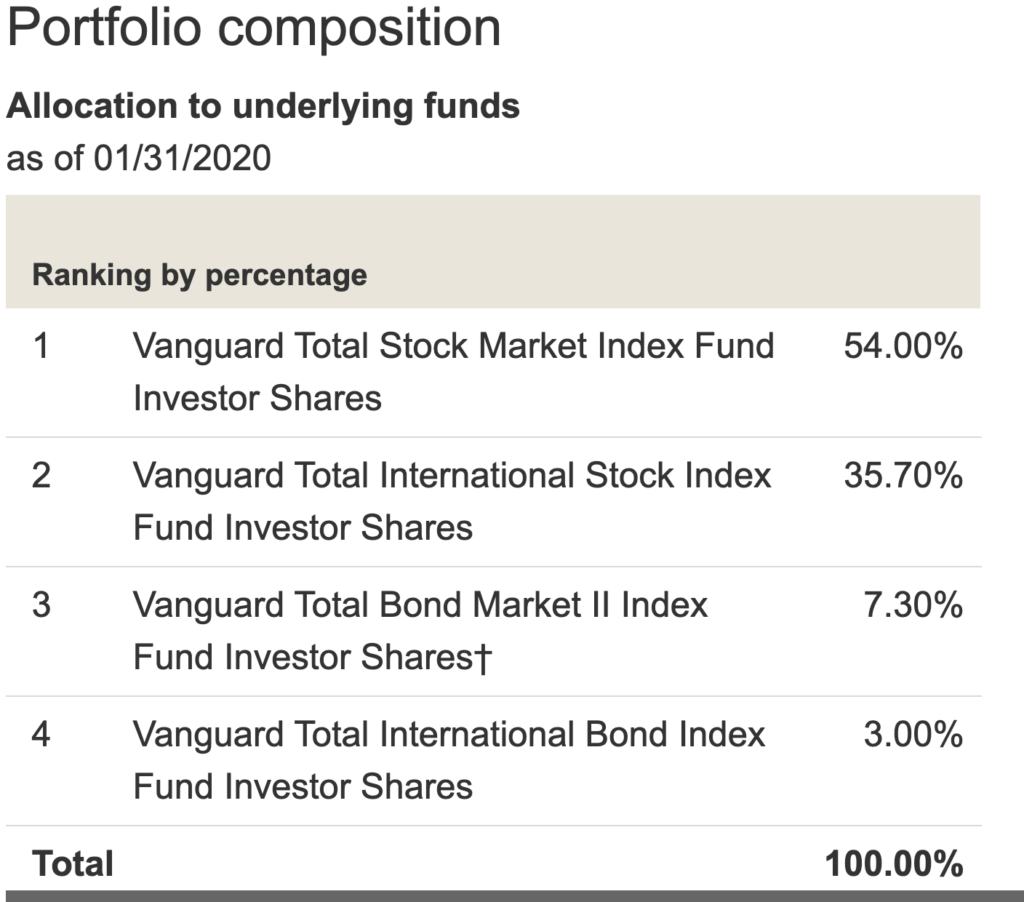

In essence, a vanguard target date fund comprises of several funds that cover domestic/international stock markets, and domestic/international bonds. For example, below is the decomposition of Vanguard Target Date 2060 as 01/31/2020 (https://investor.vanguard.com/mutual-funds/profile/VTTSX):

From historical statistics, bonds have less yield but have lower risks than stocks [10]. And also bonds distribute dividends that are treated as ordinary income. So the three-fund theory [12] tells us that if we really have a lot of money to invest, we should put bonds in tax-benefit accounts such as 401K, and move the stock index funds into taxable accounts (because holding them for long time we will only need to pay long-term gain tax, rather than ordinary income tax).

Updated 2019-05-13

Another example on how to convert after-tax to roth: Roth In-Plan Brochure

Updated 2020-05-01

This list shows historical returns for Vanguard funds, which are the main source of 401K.

https://retirementplans.vanguard.com/VGApp/pe/faces/PubFundChart?site=nyu/6370

Updated 2020-09-05

Below is the expected growth of retirement funds under a realistic estimation on a middle-class income .

Retirement Planning Calculator (US Personal Finance @ FB)

References

[1] https://www.irs.gov/retirement-plans/roth-comparison-chart

[2] https://www.bogleheads.org/wiki/After-tax_401(k)

[3] https://www.goodfinancialcents.com/401k-contribution-limits/

[4] https://www.doughroller.net/retirement-planning/pros-and-cons-of-after-tax-401k-contributions/

[5] https://about401k.com/withdrawal/after-tax/

[7] https://www.sensiblemoney.com/learn/at-what-age-should-i-start-making-401k-withdrawals/

[8] https://thefinancebuff.com/rollover-after-tax-401k-403b-access-before-59-1-2.html

[9] My company’s After-tax 401K to Roth 401K FAQ: PlanConversionFAQ

[10] https://personal.vanguard.com/us/insights/saving-investing/model-portfolio-allocations

[11] https://www.cnbc.com/2019/05/23/how-much-money-americans-have-in-their-401ks-at-every-age.html